“Never interrupt your enemy when he is making a mistake.” —Napoleon Bonaparte

When your competitors make mistakes, it makes winning so much easier. But what if it’s you who is making a mistake, while your competitors are off to the races? You won’t know until you figure out what your competitors are up to.

Knowing what the competitors are doing—how they’re thinking about the market, which tactics they’re using, how they’re crafting messages and design—can make all the difference in the battle for customers.

In addition, competitive analysis can be a treasure trove of conversion optimization insights, yet it often gets skipped. And it’s not just a CRO problem—it’s a marketing-wide phenomenon.

A Conductor study found that 74% agreed that competitive analysis is “important or very important,” but 57% admitted that they weren’t very good at it. From start to finish, this post will show you how to conduct a competitive analysis the right way.

What is competitive analysis?

Competitive analysis is a broad term for the practice of researching, analyzing, and comparing competitors in relation to yourself. Companies do it for a wide variety of reasons—SEO, branding, go-to-market strategy, pricing, etc.—and you can definitely use it for UX and conversion optimization, too.

If you invest in competitive analysis, you’ll reap the benefits of clarity and confidence. You can’t beat a competitive analysis if you want to answer questions like:

- What makes my company unique? How do we stand out?

- How do customers think of my company compared to competitors?

- How does the user experience on my website stack up to the competition?

There’s a great deal to be gained from thorough, regular competitive analysis—usability insights, design advantages, a more convincing value proposition, and of course, ideas for testing.

The limits of competitive analysis

At the same time, competitor analysis should be done with proper context. As Peep Laja notes:

I hear this all the time. “Competitor X is doing Y. We should do that, too,” or “X is the market leader, and they have Y, so we need Y.”

There are two things wrong with this reasoning: First, the reason they set up Y (menu, navigation, checkout, homepage layout, etc.) is probably random. Often, the layout is something their web designer came up without doing a thorough analysis or testing. (In fact, they probably copied another competitor.)

Second, what works for them won’t necessarily work for you. You’d be surprised by the number of people who actually know their shit. Plenty of decisions are (maybe) 5% knowledge and 95% opinion.

Indeed, even if you knew that a competitor had a higher-converting site, how would you know whether that comparative improvement resulted from the site design or email strategy or brand recognition?

You wouldn’t. As Laja continues:

It’s the blind leading the blind! So instead of just copying something, have the mindset of experimentation. The thing you copy is a hypothesis—and you need to test it.

Run it against your current site and see if it makes a difference. Then either implement or discard.

With those caveats in mind, here are the eight steps to follow to run a great competitor analysis:

- Set your goals.

- Identify your competition.

- Conduct a competitive usability investigation.

- Compare competitor value propositions.

- Interview your competitors’ customers.

- Run a competitive analysis for design.

- Make a quantitative competitive investigation.

- Run a functional investigation.

1. Set your goals.

Before you start your competitive analysis, remember the first essential truth of competitive intelligence: How one thinks about the mission affects deeply how one does the mission.

The fact that your client, leadership, or colleagues believe something about competitors doesn’t mean it’s true. We all have blinders on at times. Make sure you go in with an open mind.

It’s just as important to have clear goals:

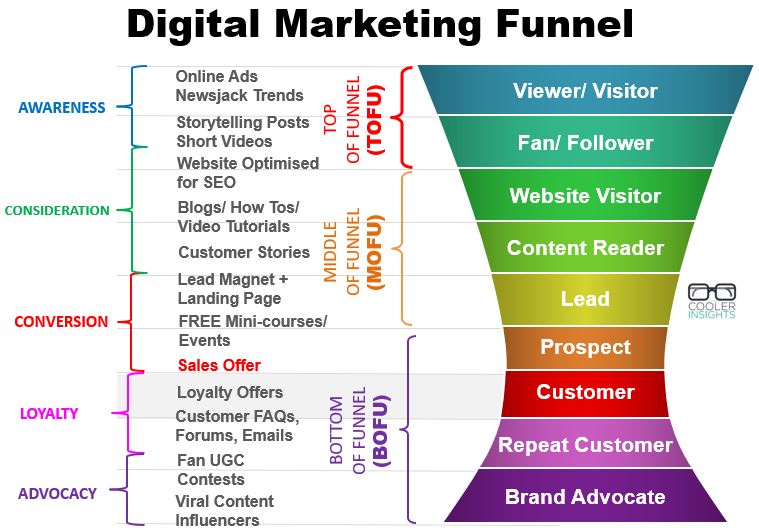

- Which decisions will your competitive research impact?

- Are you looking to refine messaging? Experiment with the funnel structure? Get inspiration for A/B or multivariate testing?

If you know your goals upfront, that knowledge will help you structure the research to meet those goals.

2. Identify your competition.

Let’s do this! This is the easiest part of the equation because you should know your industry like the back of your hand. Still, you should still conduct this step to see if there are any new players or if anything has changed with the old ones.

To find out who your top competitors are:

- Run a Google search;

- Check Google Trends, SimilarWeb, Compete, or Alexa.

- Check the list of presenters and companies running booths at your industry’s conferences;

- Ask your customers who else they considered.

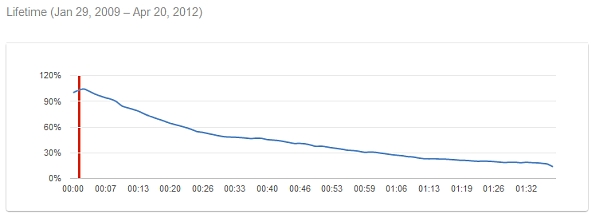

3. Conduct a competitive usability investigation.

People comparison shop. But do you know how does your site measures up? This is where comparative user testing comes the rescue.

Ask participants to evaluate your website as well as the websites of your top two competitors. (More than three website evaluations is often overwhelming for participants.) To avoid biased feedback, try not to disclose which company you’re with and mix up the order in which you show the websites to participants.

If you’re doing a moderated usability study with a sample similar to your target customers, start by asking the participants to enter a query into Google.

Ask them to use the words they would naturally use when looking for a product or service you offer. Which results show up? What do they click? Why? If your company doesn’t show up in search results or get clicked, you’ve got work to do.

Next, do a 5 second first impression test. Give a participant 5 seconds to look at the first website, then ask them:

- Which three words would you use to describe the site?

- What is it about? What products or services are offered and for whom?

- How does this website make you feel?

Then do the same for the two other websites. You’ll walk away with unstructured data as well as word clouds to let you see quickly how the first impression of your site lines up with the competition.

Next, test the key flow (e.g. check-out process). Give the participants a scenario in which they use the site to solve a problem or go through the check-out process. After each experience, ask:

- What was the worst thing about your visit to this website?

- Which aspects of the experience could be improved?

- What did you like about the website?

- What other comments do you have?

Once the participant has gone through all the websites, here comes the big question:

- Which experience did you like best? Why?

Common themes in the participants’ responses are a great foundation for hypotheses.

Karl Gilis, a web usability consultant, is a big fan of comparative user testing:

Karl Gilis:

For me, it’s incredibly interesting to see what the users like and dislike about the sites of my client’s competitors. And I’m not talking about what they think of the design, but what makes them happy and what frustrates them. What elements and what tricks seem to delight them?

The users don’t have to fulfill full tasks on these websites. You can get good results by showing different versions of the same type of page and observe their reactions and behavior.

Don’t forget to do your own heuristic homework and go through the check-out process yourself.

Things to pay attention to:

- Steps that don’t make sense from your customer’s perspective;

- Steps that are combined or eliminated compared to your funnel, as they may be superfluous;

- Upsells and cross-sells, which are additional revenue opportunities you could exploit.

Jaime Levy, a UX strategist and author, suggests looking at content types, personalization features, and community features on competitors’ websites.

As you’re doing your analysis, write down your observations, take screenshots, and give them descriptive names to make it easier to browse later.

André Vieira, founder of Looptimize, finds CRO extremely useful for ideation:

André Vieira:

You can look at many elements on competitors’ pages, such as copy, number and placement of images, page structure, page length, the next step in the funnel, amount of calls to action, types of calls to action, etc., and compare to what you have on your website and in your idea backlog.

When possible, I also find it useful to track the tests that my competitors are running. (You can use tools like Versionista or VisualPing). This gives me insight into what problems they’re trying to solve. Depending on the overlap between our audiences, I may have to solve the same problems in the future, so it’s good to learn from others.”

Karl Gilis recommends going beyond your main competitors and looking at websites in different countries or similar pages of websites out of your business area: “If you sell something online, every shopping cart or checkout procedure can be an inspiration.”

4. Compare competitor value propositions.

After leaving your website, people may remember up to three reasons to buy from you or sign up for your service. Most likely, they’ll only remember one—your main selling point. What is it on your website? Does it reflect your competitive advantage?

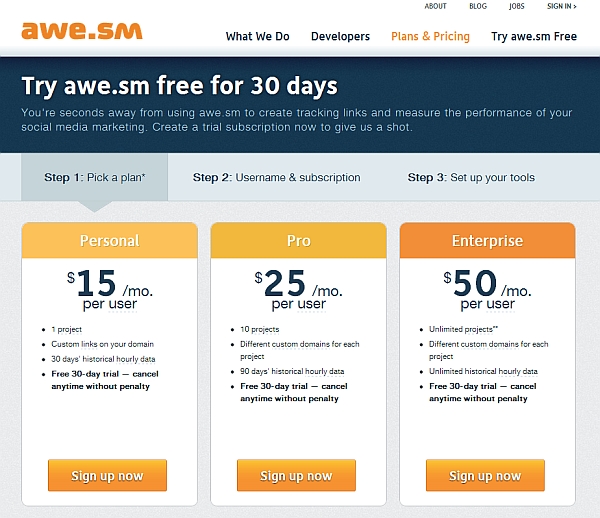

To create a value proposition that really differentiates your offer, you have to know how competitors position themselves.

To help pinpoint your unique value proposition, Chris Goward from WiderFunnel created a Venn diagram that covers three aspects:

- Points of Parity (POPs) are features you offer that are important to your prospects and shared among you and competitors.

- Points of Difference (PODs) are features that are important to your prospects and not available from competitors.

- Points of Irrelevance (POIs) are features that customers don’t care about.

Your PODs are where you’ll win the game. That said, Goward offers a word of caution:

Chris Goward:

All PODs are not created equal. Some will be more important than others and some will be important only to certain customer segments.

No matter how much effort you’ve put into researching and brainstorming your value proposition points, you should test them to validate whether they’re best!

Tony DeYoung, an SEO and CRO consultant, uses competitive analysis to craft effective value propositions for clients:

Tony DeYoung:

Most companies try to be everything to everyone and don’t create value propositions that define/target specific ideal customers. The lean, aggressive ones do. Reviewing a competitor’s online presence helps me understand how to differentiate my client. I’ m looking for benefits that are unique, not just “more features” or “cheaper.”

Reliable lifts come from knowing your customer and tailoring the value proposition to match that customer’s motivations in a way that no other website will. You can enhance it with a bunch of human behavior principles (liking, scarcity, reciprocity, social proof, consistency etc.). But you have to have the foundation of what makes you unique to get people to return to you after they browse around.

5. Interview your competitors’ customers.

Competitors’ customers are worth their weight in gold. Not only can they tell you how satisfied they are with a competing product or service, they can also clue you in as to why they picked the competitor in the first place.

To reach your competitors’ customers, use your network: Who do you know? Who do they know? Also, try “snowball recruiting”—ask every research participant whom they could introduce you to for subsequent interviews. You could ask current customers to recommend their peers for the study. (Offer compensation to both parties).

Sean Campbell recommends asking your competitors’ customers these questions:

- What caused you to start looking for a solution?

- What were your top five buying criteria (in order of importance)?

- What were the main reasons you chose the company you did?

The good old NPS survey can also come in handy. Ask:

On a scale from 1 to 10, with 10 being “Extremely likely,” how likely are you to recommend the competitor’s product to a friend or a colleague?

Please explain why you have chosen [number].

6. Run a competitive analysis for design.

Even though design is just one part of the conversion puzzle, it’s an important element of overall CRO success.

Growth designer Katya Lombrozo always does competitive analysis as part of her creative process:

Katya Lombrozo:

Before I take on a project, I ask the client for three competitor websites, as well as what their strengths and weaknesses are compared to my client’s product/service. Then, I perform my own search, going through at least two pages of PPC ads and organic results.

What I’m looking for are common trends within that vertical. They give me an idea of how to break from that mold with visual design and optimization tactics.

I analyze the story the competitors tell with their landing pages, their site UX, and transparency (e.g. reviews, trust). Then, I adjust my wireframe, making sure my client’s page can stand up to all that and more. Sometimes, all I need is a better visual design than a competitor, but, often, it’s a matter of better explaining the value proposition of the service/product and putting together a more logical flow of elements.

Khattaab Khan, Director of Experience Optimization at BVAccel, also uses competitive analysis to benchmark UX/UI and gauge user responsiveness:

Khattaab Khan:

You’re competing for mindshare with your direct competitors, especially mindshare of the users coming from organic search.

On competitors’ sites, I’m looking at the navigation, number of steps in the funnel, and structure of focused landing pages.

7. Make a quantitative competitive investigation.

You can pull a wealth of data about your competitors from SimilarWeb, including their traffic volume and key traffic sources, and organic and paid keywords.

With SEMrush, you can find your competitors’ best-performing keywords. You can also get insights into your competitors’ strategies in display advertising, organic and paid search, and link building.

Other keyword-related tools you can leverage are Spyfu and iSpionage—both allow you to download your competitors’ most profitable keywords.

Armed with your competitors’ most effective keywords, you’re in a great position to craft irresistible copy variations. Here’s Tony DeYoung explaining his process to do just that:

Tony DeYoung:

I always do competitive analysis for SEO and SEM. For SEO, I look at my competitors’ keywords and their page rank/authority. This tells me if it’s even realistic to try to rank or bid on a keyword, or whether I need to niche more. It’s also a great way to find useful sites to earn backlinks from.

This isn’t directly “CRO,” but it has an impact. The more specific I can be on search terms that uniquely lead to what I offer on my site, the higher the conversion rates.

8. Run a functional investigation.

Studying your competitors’ technology stacks can shed light on their level of maturity as a digital marketing organization. You might also get some ideas for tools to try for yourself. BuiltWith lets you take a peek under the hood of your competitors’ websites and find out exactly what software they use.

Brian Massey from Conversion Sciences uses functional analysis to help prioritize testing ideas:

Brian Massey:

In general, we find competitive analysis to be a great source of hypotheses in CRO.

Competitive analyses are also ripe for misuse. We want to “steal” ideas from competent competitors who aren’t making the same mistakes that everyone else is, namely, designing without data.

We can get a very good idea of a company’s capability by examining the tools they’ve installed. We start by installing the Ghostery extension in our browser. Ghostery examines the tags that live on a website.

You could score your competitors on a scale from “Rookies” to “MVPs.” Rookies have no analytics or experimentation tools on the site. MVPs have a full suite of analytics, UX tools, and A/B-testing solutions.

- Give a company 1 point for an analytics package (usually Google Analytics).

- Add 1 point for tag management (usually Google Tag Manager).

- Add 2 points for UX tools. Look for heat-map and session-recording tools or survey and feedback tools.

- Add 5 points for A/B testing tools. If they’re using these tools, they’re using some of the most reliable data available.

If your competitor scores 7–9 points, you should test ideas you find on their site first.

If your competitor scores 3–6 points, test their ideas second.

Anything less? You should consider their ideas with great skepticism.”

Conclusion

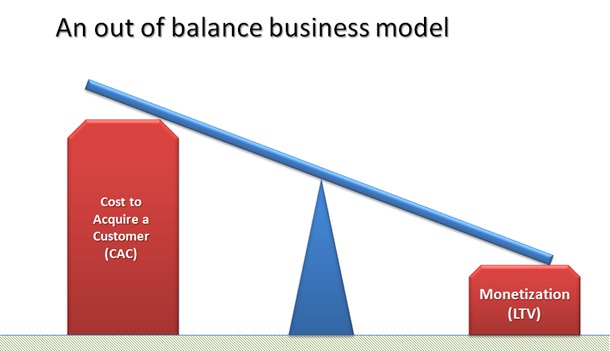

Competitive analysis, like money, is a great servant but a poor master. Being reactive to what competitors do can be worse than doing nothing.

At the same time, knowledge is power—simply knowing how you compare to your competitors in the minds of customers can make a world of difference.

You may find that adding regular competitive analyses to your CRO process and adapting your strategy based on that analysis will fuel your creative engine and positively impact conversions.

Competitive analysis doesn’t have to be a standalone, herculean effort—you can weave it right into the research you’re already doing.

The post How to Do a Competitive Analysis: A Step-by-Step Guide appeared first on CXL.